গরমণ বযক is a microfinance organisation and community development bank founded in BangladeshIt makes small loans known as microcredit or grameencredit to the impoverished without requiring collateral. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture.

Ger Explore The Benefits Of Choosing Quicken Support Service Quicken Support Number P App Development Downloads Folder Mobile App Development

Grameen Bank originated in 1976 in the work of Professor Muhammad Yunus at University of Chittagong who launched a.

. Islamic banking Islamic finance Arabic.

Global Islamic Finance Finance Islam Global

How Much Money Can You Gift Tax Free The Motley Fool Gifts Money Gift The Motley Fool

Organization Of Library Services For Hospital Patients

Handing Over Keys Cash At House In 2022 Real Estate Investing Selling Real Estate Real Estate

Planner Inserts Debt Payoff Credit Card Interest How To Calculate Credit Card Interest Creditcard Cr Budgeting Money Budgeting Credit Card Debt Payoff

Bundestagswahlen Gemeinde Henstedt Ulzburg

Credit Risk Management In The Development Bank Of Ethiopia Effects On The Quality Of Loan Portfolio Grin

Bank Islam Offers Zakat Fitrah Payment Via Snapnpay

Banking App On Behance Banking App Banking App

Maximizing Islamic Finance For Financial Inclusion

Banking App Wireframes Banking App Wireframe App

Paytm S Partnership With Suryodaya Small Finance Bank Finance Bank App Business

Late Bollywood Actor Om Puri Honoured At Oscars 2017 Bollywood Actors Actors Bollywood

What Does The Future Hold For Islamic Finance Atalayar Las Claves Del Mundo En Tus Manos

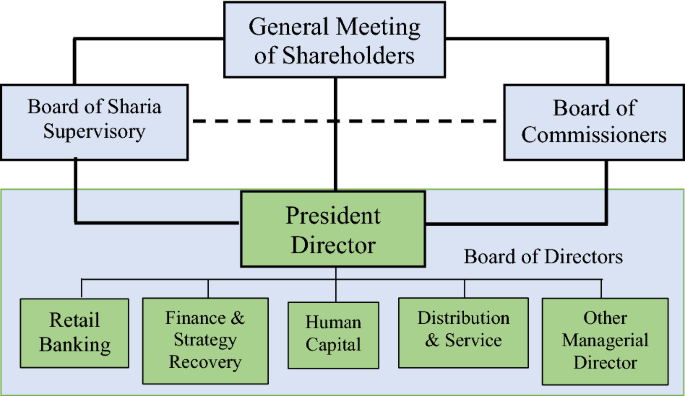

Do Board Characteristics Affect Bank Risk Taking And Performance Evidence From Indonesian And Malaysian Islamic Banks Springerlink